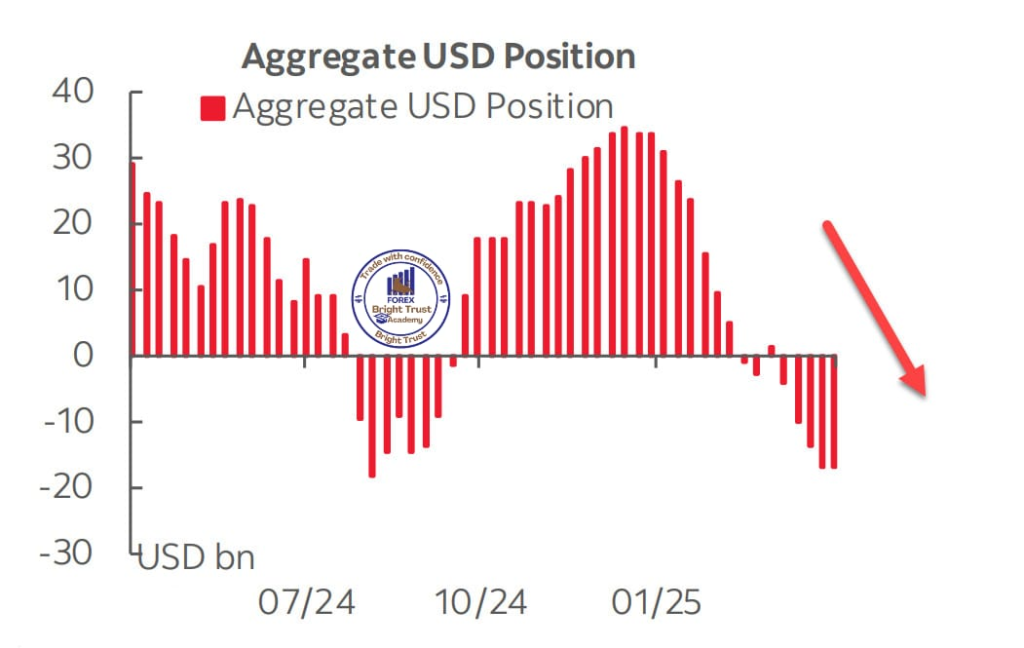

The CFTC report released on Friday showed minimal changes in overall currency positioning Net USD positioning against major currencies decreased slightly by 0.1 billion to negative 17.2 billion Investors remain cautious due to high uncertainty and the market stands in a fragile balance awaiting fresh data

The futures market continues to price in three Federal Reserve rate cuts this year with only minor adjustments Inflation expectations rose slightly following the release of secondary labor market data Unit labor costs increased by 5.7 percent in Q1 well above the previous 2 percent and the forecast of 5.3 percent This led to a rise in yields on 5-year Treasury Inflation-Protected Securities

The April consumer inflation report will be published on Tuesday Forecasts are neutral with headline and core CPI expected to match the previous month However uncertainty remains high as the US economy is facing conflicting forces that could drive inflation either higher or lower

One key factor is ongoing tariff negotiations with China Chinese exporters have sharply reduced shipments to the US While current inventory levels are sufficient the buffer is shrinking Without a mutually acceptable resolution inflationary pressure is likely to rise Reports indicate progress toward an agreement Both sides have agreed to a 90-day delay on new reciprocal tariffs during which they aim to finalize a balanced solution

Markets reacted immediately to this positive development On Monday the dollar strengthened significantly especially against the yen as a safe-haven currency The US Dollar Index reached a one-month high though it remains below levels seen before April 2

In recent months the dollar has been under pressure due to unilateral actions by the Trump administration that threatened global financial stability The latest optimism has supported risk assets and may provide renewed strength to the dollar

For now the threat of a US recession has receded Recent data has not raised any major concerns The Atlanta Fed’s GDP Now model forecasts Q2 GDP growth at 2.3 percent easing fears of a weak Q1 However it is important to note that current market optimism is largely driven by speculation and rumors rather than confirmed developments

Bright Trust Academy☀️