The collapse of gold following the Republican victory in the US elections was a real shock for XAU/USD bulls, yet it has not thrown them off track. The precious metal was seen as one of the main beneficiaries of Trump-era trade policies but, in reality, lost some of its hard-earned gains. Neither the political crisis in France, the declaration of martial law in South Korea, nor the breakdown of the ceasefire between Israel and Hezbollah has been able to support it. Nevertheless, Goldman Sachs still forecasts prices rising to $3000 per ounce, and it is not alone in this prediction.

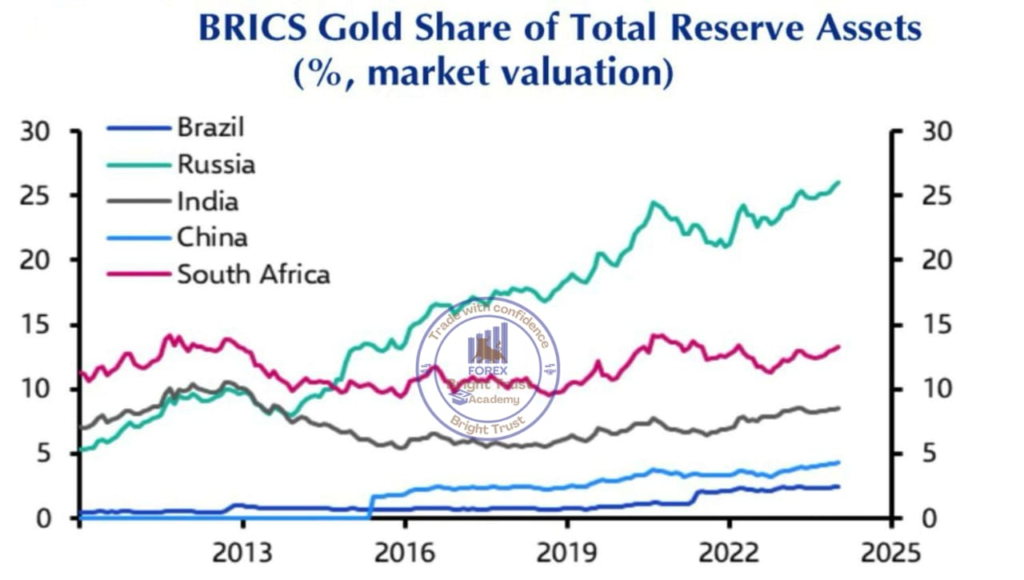

Capital Economics believes that despite the strong headwinds in the form of a strengthening dollar and rising Treasury yields, gold is likely to rise. The rally in XAU/USD will be driven by alternative factors – central bank gold purchases and the revival of demand from China.

It is commonly accepted that gold rises during periods of Federal Reserve monetary policy easing and falls when the central bank raises interest rates. However, in 2022-2023, XAU/USD prices rose even amid the most aggressive monetary tightening by the Fed in decades. The key to this lies in record central bank gold purchases as part of de-dollarization and reserve diversification efforts, as well as China’s insatiable appetite for gold.

Bright Trust Academy